What is an expense in accounting? What kind of question is that?????? Read on and you will understand the question and why it is relevant. I promise!

My motto is Finance is for Everyone and I stand by it always. With this I mean to say that everyone in your organization should feel engaged in their contribution to proper finance management but also that really everyone can learn about finance and be cool about it. It is not rocket science. However, that does not mean that it is so simple that you can handle it without giving it some tender love and care.

So back to today’s question: what is an expense in accounting? Maybe I should rephrase and say, when does something become an expense in your bookkeeping? When should you record something you may or may not have yet paid for in your books as an expense that could end up in a financial report for a funder as one of the reported costs?

Key here is, that an expense should be clearly defined in an invoice or bill and it should be possible to provide proof of delivery of the thing you paid for (or will pay for). So, it could be an invoice from a trainer you hired to conduct a workshop with your target group for which the trainer has provided you with a report. Or it could be a bill from a restaurant that provided meals to your group. (in a later blog I will speak more on proof of delivery). Key is, there is clarity on what you pay for and on the final price for this thing.

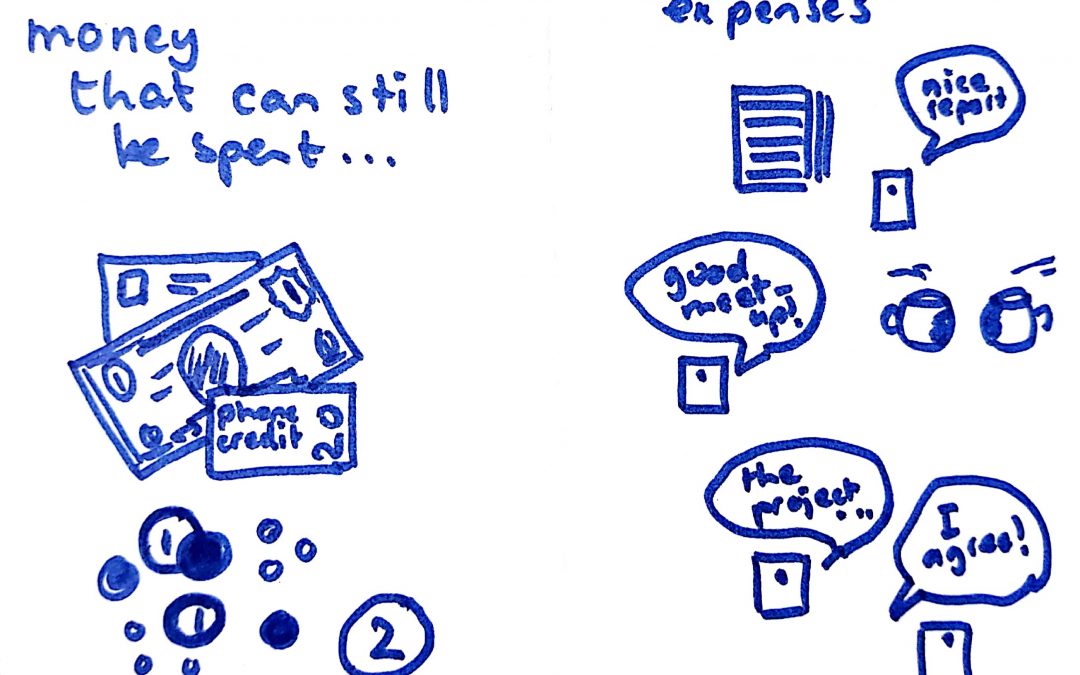

If you give someone on your team some cash money so that they can cover expenses on a business trip, this amount is not at that time an expense you can account for. After all, you do not know what the final cost will be exactly. It is possible your team member will come back and return some of the money because it was not needed. Or if something unexpected happened, they might have incurred more costs than planned. Or, something might happen, and they might need to cancel the trip altogether. In short, at the time you give your team member the money there are intentions for spending it in a certain way, but no more than that. And for that reason, this money cannot be seen as an expense at that time.

It helps to check whether or not you already have proof of delivery of the thing you (will) pay for. If you follow this line of reasoning, it follows that credits for phone or public transport costs are also technically not yet expenses. The credits might not be used, or they might be used for private objectives, which are nothing to do with your organization and its activities. You do not know this at the time a person tops up their credit. Topping up a credit just means that money is being moved from one location (a bank account or wallet) to another (a credit line with a phone company or public transport company) without it being actually used.

Only once you know, through an itemized overview for instance, how the credits have been used, can you assess whether or not this is an expense that fits within your reimbursement policies and/or within the funded activities. Any payment for which you cannot make this kind of assessment, is not something you can record in your bookkeeping as an expense. (obviously, you must record any payment made even if it is not yet an expense, but that is another story).

As soon as you record an item as an expense it might become part of the cost items reported to a funder. If you, through a financial report to a funder, tell the funder that you incurred this cost for the activity they are funding, they might want to be able to see proof that this is correct. Anything you cannot fully and clearly account for can create an issue.

Therefore it is really important to check carefully when you record something in your books: do you need to receive further justification and documentation of the payment to a staff member or someone else who received money in advance in order to know for certain what kind of costs were incurred, for what amount and for what purpose? If yes, then you record this amount as an advance payment (and make sure you remind the person of the need to account for the advance money they received). If you do have all information about the full total costs and the purpose of the costs and have proof that the paid for services or goods indeed were delivered and approved, then you record the item as an expense. And if you do, you will be confident that if anyone would come looking, you have all the documentation needed to show what that expense is about.

Feeling confident that everything is in good order is a big deal for all the finance people in not-for-profits I know. For me, too. I feel that every time I prepare a financial report. And I know I will feel this in the coming week, when preparing a report for a funder, and going through all the paperwork again. Finance is not rocket science, but it needs tender love and care!

How I can help

My free checklist helps you make sure your report is complete: https://www.changingtides.eu/checklistannualreport

If you would like simple steps to set up and organise your finance & admin foundations guidance by me, you can get a bundle of six simple and short workshops here: https://www.changingtides.eu/financeandadminbundle

In case the bundle is too much for you at this moment, feel free to pick one or more of the workshops individually:

- Set up your financial processes: https://www.changingtides.eu/financialprocesses

- Understand important basics of bookkeeping for nonprofits: https://www.changingtides.eu/bookkeepingfoundations

- Be sure you are keeping all the documents you need for project donors, auditors, or officials: https://www.changingtides.eu/documentationfornonprofits

- Plan your cash flow for a year: https://www.changingtides.eu/cashflowfornonprofits

- Get a feel for how time sheets can be helpful to everyone in your nonprofit and set them up straightaway: https://www.changingtides.eu/timesheetsfornonprofits

- Learn how to calculate the price of time spent of your team members, including allocations for general costs that are used in different projects: https://www.changingtides.eu/feesfornonprofits

Please note, the bundle is cheaper than buying all six workshops separately: https://www.changingtides.eu/financeandadminbundle

Want to know more and ask questions?

If you want to discuss this more – jump into my nonprofit support community and get input from a wide range of peers and from myself!

Here is how you can join my free nonprofit support community

You can join my free nonprofit support community on the Heartbeat platform here. This group is a safe space for open exchange and discussion on potentially sensitive topics like boards, nonprofit management, fundraising, etc.

You can visit the community via a browser or via an app. Here is the link to download the Heartbeat chat app in the Google Play store.

Want to support me with a cup of coffee?

The seaside always inspires me and helps me think of articles, videos, workshops and courses I can create for you.

If you want to support me without getting a paid workshop, course or review – you can donate me a coffee and speed up my thinking process!

You can support me here: https://ko-fi.com/suzannebakker

Thanks for your helpful words, Suzanne. Liked your opening email from this week (2/12) even more than last week’s – progress!

Hi Tom, that is so nice to hear! Thank you! Obviously I am curious to know WHY you liked this week better than last?